What inspired your business?

Snoop was founded by a group of highly experienced former Virgin Money executives, led by the bank’s former CEO – and Snoop Chair – Dame Jayne-Anne Gadhia.

We shared a belief that creating an Open Banking-based proposition would enable us to deliver profoundly better outcomes for consumers.

What problem are you trying to solve and for whom?

Research shows that inertia and/or apathy costs consumers some £12 billion per year – this is known as the loyalty penalty.

To put this into context, 8/10 consumers end up overpaying for at least one essential service, for example on their energy, mobile, mortgage, insurance, broadband bills.

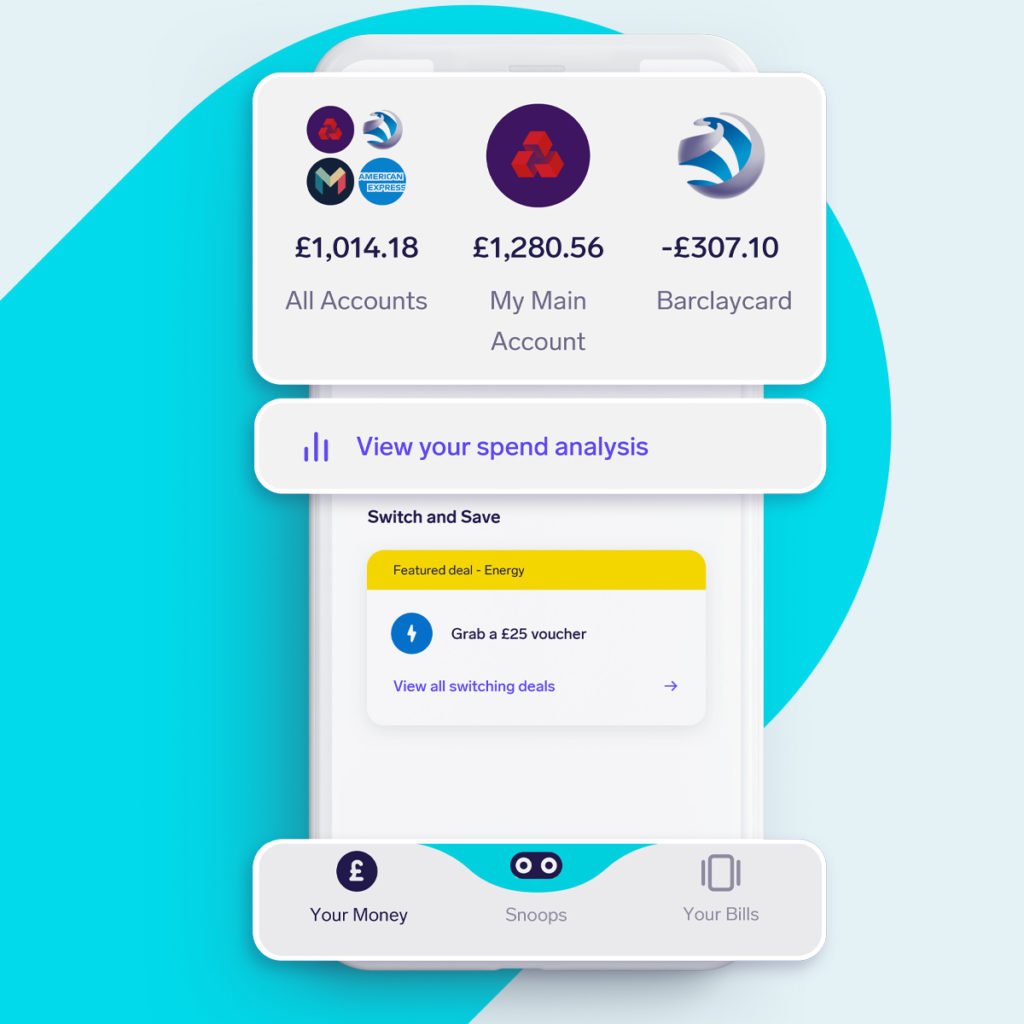

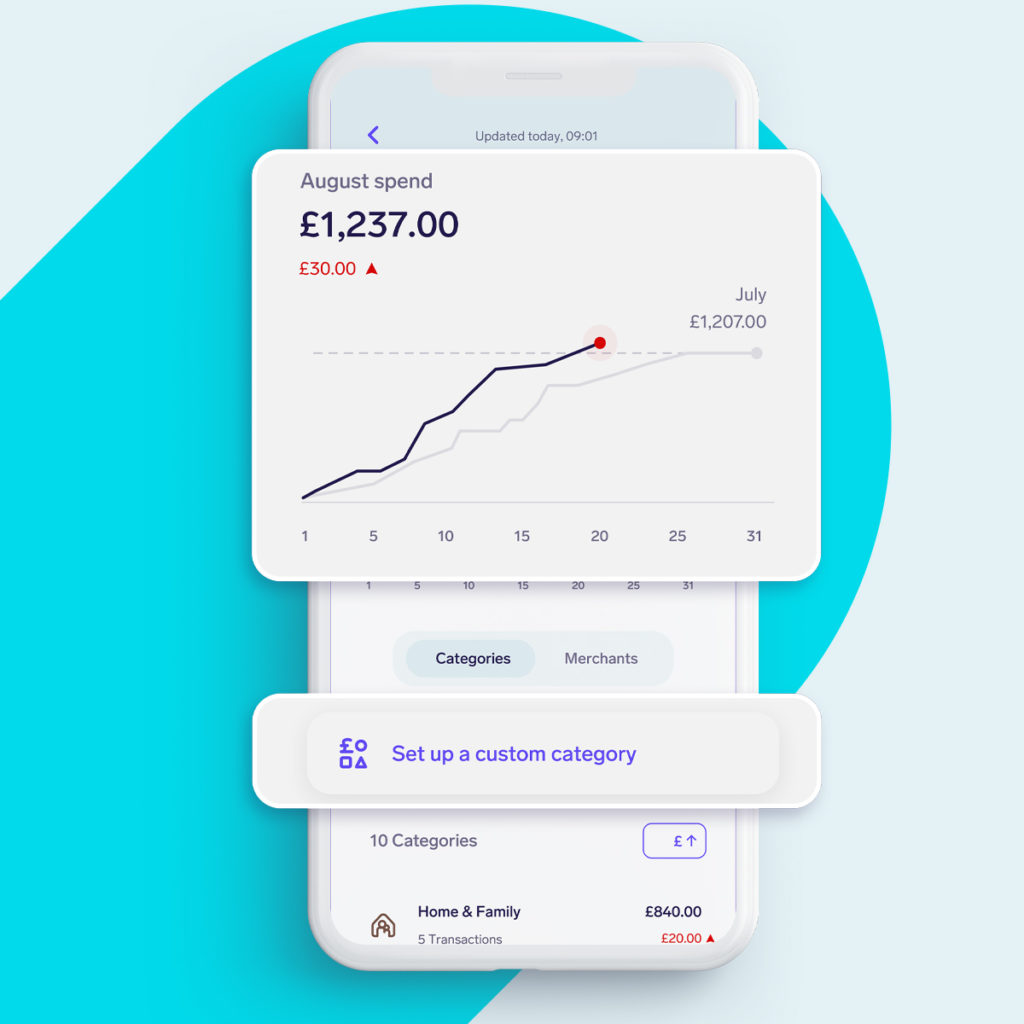

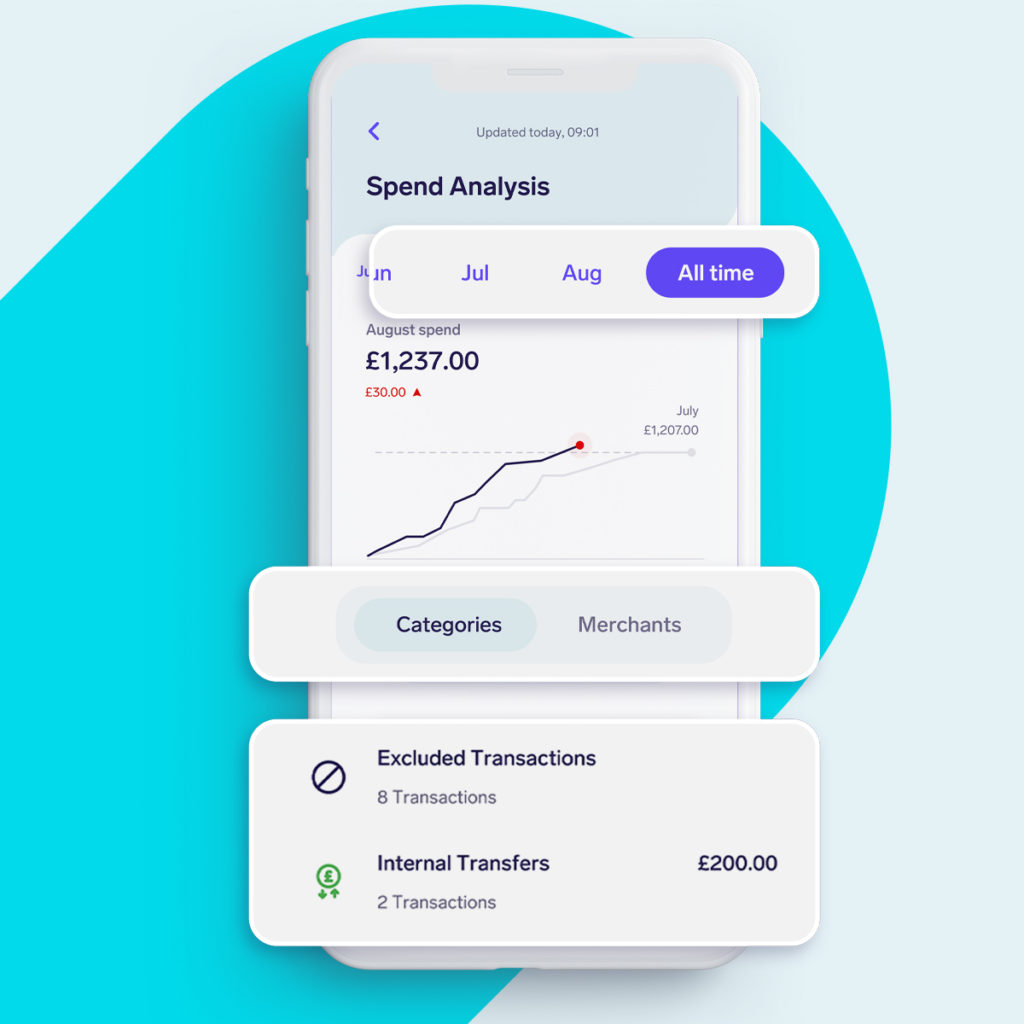

To combat the loyalty penalty, each day Snoop creates a unique feed of money-saving ideas, 100% personalised based on an individual’s banking data.

We’re all about making it as easy as possible to put a big chunk of cash back in people’s pockets.

By helping customers to switch to better deals across their household finances, at exactly the right time, Snoop can help the average UK household save £1,500 per year.

How do you differ from the competition?

Hyper-personalisation is what makes Snoop different to other apps in this space.

By being hyper-personalised the Snoop platform is super relevant, practical and useful in the everyday lives of people.

The app takes the idea of money management much further than other fintechs by allowing customers to use their own data as a powerful force to save money.

Where do you see your company going in 5 years?

Our ambition is to make everyone better off. We believe making better financial choices can change lives and Snoop can help people use their data to make better financial decisions and save money.

This summer we secured £15 million in Series A funding from leading American investment management firm Paulson & Co. Inc.

The funding from Paulson will be used to continue to scale rapidly, fund product and distribution development and extension, as well as aid international expansion.

Open banking (and Open Finance) are major growth opportunities within the financial sector.

We’re building a business with unstoppable momentum and we want to become a global leader, synonymous with open data and smart banking.

What has been your biggest challenge so far?

Snoop wants to make open banking work for everyone. Doing so will play a significant part in improving financial literacy and help drive better financial decisions and outcomes for all consumers.

Trust in providers delivering open banking services (either third party providers or banks) is the key determinant of whether consumers and SMEs are likely to use such services.

The biggest nine high street banks (known as the CMA9) were mandated to create open banking as part of the Competition and Market Authority’s Retail Banking Remedies.

Despite the technical framework and standards that will allow open banking to flourish being in place, one of Snoop’s biggest challenges is overcoming misconceptions relating to data sharing.

We believe it should not just be down to smaller businesses and fintechs to do all the heavy lifting in building consumer awareness and trust.

Afterall, fulfilling the potential of open banking rests on consumers putting their ‘active trust’ in the industry and the industry doing its bit to actively promote regulated services.

To this end we have asked the Competition and Markets authority a simple question: ‘If banks were mandated to great open banking, should they not be mandated to promote open banking?’

Not happy with just innovating through Snoop, we believe that the banking sector could and should be doing more to promote the overall benefits of open banking so more people can benefit more quickly.

In my view it’s essential if we are to rapidly turn 3 million users into 30 million and meet the original objectives of delivering effective competition and innovation to the retail banking market.

What has been your biggest win so far?

Outperforming our business plan, industry awards, fantastic support from our investors have all been great, but for me, nothing beats reading our customer feedback.

Someone wrote to us recently to say they’d paid off almost £15k in debts since Christmas thanks to Snoop.

Creating something from scratch and realising the ways it is helping and benefitting real people is very rewarding.

What is the next big challenge for your business?

it’s all about continuing to grow quickly and profitably – put a massive dent in the £12 billion loyalty penalty as we do so – and from open banking to open finance – new features, new partners, new territories – there’s a world of opportunity and we have a team ready to grasp them.

How do people get involved/buy into your vision?

Customers can download Snoop from the App Store and Google Play. Businesses aligned to our ambition to make everyone better off and interested in partnering with Snoop should email [email protected].