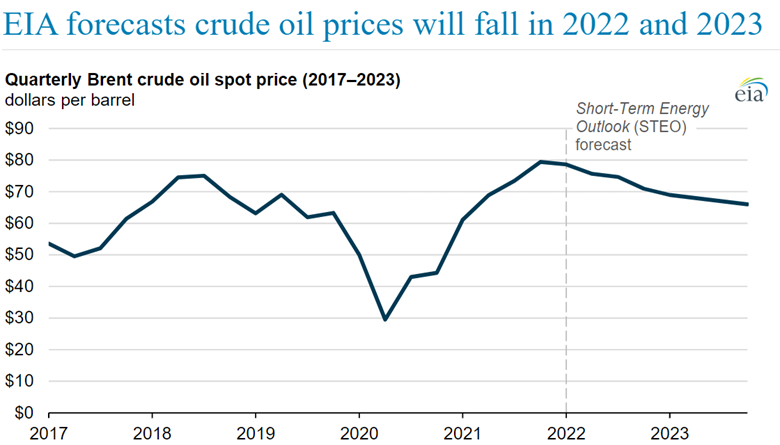

The outlook for brent oil prices is suffering as factors such as high inflation, rising interest rates, and surging COVID-19 cases in China depress demand growth around the world. As a result of this gloomy picture, economists predict that the economy may not begin to improve until early.

Brent Oil Prices Suffering.

Due to the current economic climate, brent oil prices have been adversely affected. Inflation is on the rise, interest rates are increasing, and COVID-19 cases in China remain high, all of which have decreased demand for oil globally.

As a result of this bearish market sentiment, experts anticipate that it may take until early 2023 before conditions begin to improve. This bleak outlook means that brent oil prices will likely continue to suffer in the short and long term unless measures are taken to mitigate their effects.

Economics Set to Change in 2023

The global economic outlook for 2023 is set to be drastically different from that of years past. With governments across the world making new fiscal policies, changing regulations, and implementing stimulus packages to offset the effects of COVID-19, economists are expecting a shift in market trends over the course of this year.

In particular, many anticipate there will be an increase in investment into renewable energy sources as well as changes in taxation schemes which could potentially benefit smaller businesses. International trade patterns may also change due to various geo-political factors such as Brexit or China–US relations.

Source: U.S. Energy Information Administration, Short-Term Energy Outlook

Ultimately these changes are expected to have a significant impact on how economies operate and interact with one another during this period. As such, it is highly recommended that investors remain vigilant and keep up with any developments related to economics during this time frame so they can stay ahead of potential opportunities or risks when making investment decisions.

The effects of high Inflation and Rising Interest Rates

High inflation and rising interest rates have had serious consequences for the global economy. The increase in prices has resulted in a decrease in consumer spending, as people are unable to afford goods and services that were previously accessible. This has caused a decrease in economic activity, leading to lower growth rates and increased unemployment.

Moreover, businesses may not be able to acquire capital investments due to high borrowing costs caused by increasing interest rates. As a result of this situation, companies may need to cut back on their production or lay off employees which could further reduce economic activity.

Furthermore, central banks may also find themselves unable to provide stimulus packages due to an inability to finance them with higher borrowing costs further exacerbating the current economic climate. Ultimately these effects can cause long-term damage if left unchecked as they threaten both business profits and job security for individuals around the world.

Surging COVID-19 Cases in China

The surge in COVID-19 cases in China has had a substantial impact on the global economy. With over 8 million cases confirmed, it is estimated that the pandemic will cost China’s economy 1-2 percent of GDP growth for

This figure does not factor in the long-term economic effects caused by disruptions to supply chains and businesses worldwide due to travel restrictions and other measures enforced by governments to contain the spread of the virus.

The increased health risks associated with travelling or doing business in a country where coronavirus is widespread also pose an additional threat to international trade, as companies may be reluctant to enter into new agreements with partners from these areas out of fear of contagion.

Moreover, surging COVID-19 cases could have serious implications for global markets if left unchecked as investors become increasingly concerned about their investments and potential returns. As countries across Asia grapple with rising infections and lockdowns stall economic activity further.

There is likely going to be heightened volatility on stock exchanges around the world which could lead to decreased investor confidence leading them to move away from riskier assets such as stocks or commodities like oil towards safer havens such as gold or bonds resulting in downward pressure on prices globally.

Therefore it is essential that governments take action now through effective containment strategies and public health initiatives so we can limit any adverse impacts this crisis may have around the globe going forward.

Depressing The Outlook for Brent oil Demand Growth in The World

The outlook for Brent oil demand growth in the world is increasingly bleak, as the global economy continues to suffer from the effects of COVID-19. The pandemic has caused disruption and volatility across many industries leading to decreased economic activity, especially in sectors that rely heavily on international trade.

In particular, transportation and tourism have taken a severe hit with air travel down by over 70% worldwide and passenger car sales dropping drastically in countries such as China, India, and Brazil. This reduction in economic activity is having an adverse effect on oil prices with Brent crude falling around 40% since 1st January.

Moreover, there are no signs of an imminent recovery anytime soon due to rising cases of coronavirus globally which could further depress demand for Brent oil. Countries such as India have imposed lockdowns once again while others including Japan have recently declared states of emergency due to surging infections resulting in decreasing consumer confidence levels across the board.

These measures will only serve to exacerbate already weak spending habits among consumers who may be unwilling or unable to purchase goods or services until health conditions improve significantly around the world leading further downward pressure on Brent Oil prices going forward into

Final words

It is apparent that brent oil prices will remain challenged in the coming years as a result of macroeconomic factors such as rising inflation, increasing interest rates, and the resurgence of COVID-19 cases in China. These events are likely to depress worldwide demand growth for brent oil and create uncertainties for the energy industry moving forward. While some may view these risks as daunting, it is important to remain positive and be ready to adapt quickly to changing economic environments.